About Firm

M Y Singhania and Company was established by CA Yogesh Kumar Singhania and CA Mamta Amit Singhania. Our team comprises of dedicated professionals possessing expertise across a range of business accounting, tax and consultancy needs. Our team includes Chartered Accountants, MBAs and Engineers. Our head office is in Hyderabad and branch is in Navi Mumbai. Having established ourselves strongly on Indian grounds, we are helping MSME’s and Private limited companies for their accounting, tax and consultancy requirements. We are committed to deliver quality services and maintain high professional ethics.

VISION AND MISSION

Our Mission is to provide the best and timely accounting, tax and consultancy services to the MSME’s and Private limited companies

CA Yogesh Kumar

Chartered Accountant (India) with overall experience of 13 years in external audit in US and India possessing excellent technical skills and vast exposure across FSI

CA Mamta Singhania

Chartered Accountant (India) with overall experience of 13 years in Indirect Taxation, Direct Taxation, Individual Tax planning & compliance.

Vibha R Gupta

Master in Business Administration and B.E with an experience of 13 years in the field of Marketing, supply chain Management and Training and Education.

Our Portfolio

Businesses are in need of cost-effective reporting processes to support the ever-increasing demand of regulatory reporting under the scarce resources also need assurances around timeliness and accuracy of reporting, not just a means to improve resource efficiency.

- Capability

- Targets

- Proposition

- How To Engage With Us

- Financial Reporting Support Services

Capability Overview

Our teams consist of Chartered Accountants, MBA and Engineer who are subject matter experts to help bring the right skill sets to a client’s financial reporting infrastructure and resources. M Y Singhania and Company’s capabilities in Financial Reporting include consultative attitude and focused on optimizing our clients’ reporting execution in a sustainable manner. Our teams assess your reporting operations to uncover inefficiencies in process and support both financial and regulatory reporting requirements. Through our assessments, we develop a roadmap to close gaps and transform business in a way that their financial reporting process is efficient, before time and address the risks. Our consultative approach is flexible enough to address the financial reporting requirements of micro, medium and small business houses.

Our Targets

Our target markets consists of the following Forms of Business:

- Small Individual Business Owners

- Partnerships, LLP, LLC

- Non-Public companies

- Public Companies (limited offerings)

- India (AS and Ind AS)

- US & Canada (US GAAP)

- UK & Germany (IFRS)

- Australia and Middle East (IFRS)

Our Value Proposition

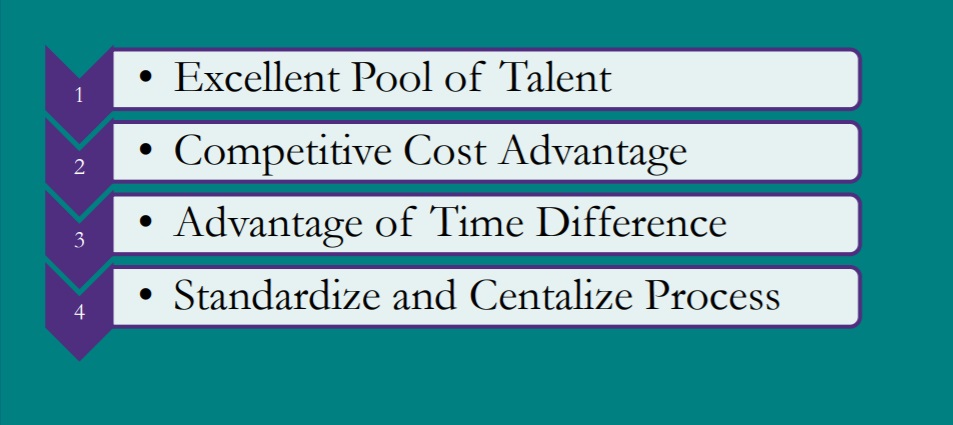

Leveraging our expertise in financial reporting requirements and business process optimization, our value proposition leads to four distinct outcomes:

1. Excellent pool of Talent which led to Quality in everything we do.

2. Better leveraging the use of limited and scarce resources which results in cost efficiency

3. Improving the speed at which financial and regulatory reports are created using the timing differences in different geographies

4. Standardization and Business continuity and Back up team in the Crucial times

How to Engage with M Y Singhania and Company Phase 1

Business Assessment- Understanding Form, Nature and Size of Business and identify the scope of services

Most Businesses are looking for better ways to bring value to the business. In our experience, the Finance reporting functions of many companies contain an excessive number of manual, redundant and lower risk activities that prevent financial reporting leaders from focusing on the core issues, high and significant risks. Recognizing this issue as an important issue, M Y Singhania and Company‘s methodology helps us create a path to divide the financial reporting functions and sub functions in to two bigger bucket and focus accordingly. While our approach is comprehensive in nature, it is not rigid and can be tailored and scaled to meet the unique needs of each client. We help our clients explore new possibilities. Just a few of the objectives our approach can help clients accomplish are as follows:

- Understand your business strategy and the financial reporting processes to support it

- Understand how well you get relevant information into the hands of the right people in a timely manner to make good business decisions

- Identify the strengths and area of improvement of current financial reporting processes, including key factors for your success

- Identify opportunities for reducing costs in financial reporting processes while increasing the value we can provide

- Understand existing controls, systems and accounting policies to support financial reporting processes

- Determine how to leverage M Y Singhania and Company’s capabilities based on the identified areas

- Develop a future state vision that sets the overall direction for financial reporting processes to increase your value

- Decide the initial scope of the service for Pilot and Create a roadmap for helping you achieve your desired future state while realizing incremental benefits at each step

Business Engagement Phase 2

Data Sourcing and Run a Pilot ExecutionM Y Singhania and Company's approach is designed to be flexible around information gathering and analysis, leveraging current / available work streams, content, and knowledge, including our own experience with the financial reporting.

This section summarizes our approach to engagement with a new business for a financial reporting architecture and processes, including data sourcing, process and controls, workflow, and monitoring.

Data Sourcing- First, we would identify the information required for financial Reporting. Furthermore, we would share the list of the required granular data attributes from the business.

- Prepared all financial reports for the areas identified for the pilot project.

- Engaged with business, as necessary, and managed all issues and risks through to resolution.

- Established strong working relationships and built partnerships with the business and its staff.

Business Engagement Phase 3

Obtain feedback on Pilot and finalize scope of services Obtain the feedback- M Y Singhania and Company will obtain the feedback on the Pilot from the stakeholder involved.

- Analyze what went well and what can be enhanced.

Based on the experience and the feedback, M Y Singhania and Company will finalize the scope of services

- Develop a framework to enhance the process of financial reporting.

- Ability to minimize effort, increase efficiency/data quality.

- Define data flows and architectures which allow for responsibility for financial reporting

Financial Reporting Support Services

How and where we can assist you

- Setting up or Roll forward of Prior year Financial statements

- Documentation assistance in process walkthroughs

- Preparation of process flow diagrams (Flow Chart and Narratives)

- Support in internal audit work

- Roll-forward of walkthrough templates

- Conducting review of walkthrough files prepared by internal audit

- Prepare the schedule of equity, agreeing the opening balance, closing balance and the movements to the relevant supporting

- Agree dividends payments to board or authorized committee minutes.

- Prepare Bank Reconciliation statements

- Prepare cash flow statement

- Prepare and Tie out fixed asset roll forward

- Calculate depreciation expense

- Lease accounting

- Preparing footnotes related to the Leases

- Calculate the Inventory valuations based on the price supports provided.

- Calculate amount required provision for – Expiry goods, damaged goods, near to expiry.

- Tying the confirmation from third party vendors

- Prepare and roll forward the physical inventory verification instructions

- Summarize AR detail by customer and reconcile with GL

- Identify customers with a credit balance

- Scan detail for duplicate invoices or other unusual items

- Ageing AR detail

- ASC 606 (5 Steps) Compliance

- Prepare debt roll forward.

- Calculate the Interest expense and Interest payable at the Monthly of yearly closing

- Compliance with the Debt Covenants and preparing the covenant compliance certificate

- Level 1 Pricing and valuation.

- Reconciliations with custodian

- Calculation of Realized Gain/Loss Testing

- Identify the investments purchases/sold but not settled.

- Calculating the management fee expenses

- Support in preparing the Goodwill valuation report based on DCF and Market approach.

- Calculating the impairment

- Step Zero Analysis

- Reporting Unit identification Memo

- Journal entry completeness testing

- Identifying the following

- Any entry posted on Holiday

- Posted by unauthorized person

- Entry out of average range

- Debit to Sales other than Sales return

- Credit to Debtors other than payments

- Debit to Fixed Assets from Purchase

- Prepared the draft financial statements based on PY and cross reference to Trial balance, B/S, I/S, Equity and Cash flow, foot face of the financials

- Prepare the Foot note disclosures

- Complete tie out of the financial statements, including footnotes to schedules and G/L, cross reference numbers from footnotes to the financials

- Preparing GAAP Disclosure check list and validate that based on the current year draft FS.

- Board minutes summarization

- Summarization of key terms of the contracts.

- Reviewing SSAE 16 Reports (Identify any deficiencies and relevant user entity controls)

Our Team

CA Yogesh Kumar

Managing PartnerChartered Accountant (India) with overall experience of 13 years in external audit in US and India possessing excellent technical skills and vast exposure across FSI.

CA Mamta Singhania

PartnerChartered Accountant (India) with overall experience of 13 years in Indirect Taxation, Direct Taxation, Individual Tax planning & compliance.

Vibha R Gupta (MBA)

Head Of OperationMaster in Business Administration and B.E with an experience of 13 years in the field of Marketing, supply chain Management and Training and Education.

Contact Us

Our Address

Shop No. 1, H.No. 7-13, 2nd Floor, In front of Bata showroom, Hydershakote Village, Ranga Reddy, Telangana, 500091, India

B 1401, The Orien CHS, Plot No. 12 & 13 Sector 20, Kalamboli, Raigad, Maharashtra-410218, India

Email Us

Info@mysinghania.com

Call Us

040-40271346

+91 9052000395